Understanding Point of Sale ROI: Getting to Grips with Costs and Benefits

POS upgrades are one of those inevitable and necessary business investments that come around every few years. Given the pace of innovation, technology is something you have to invest in more often than most other things if you want to keep up with the competition.

But whether you’re looking to update ageing POS terminals, upgrade to the latest software, or revamp the customer experience with different options like self-service, there’s one thing you’re always looking for when you spend – as much bang for your buck as possible.

Or, as it’s more formally referred to, a positive return on your investment (ROI).

ROI is a simple but fundamental idea in business. It’s a straightforward comparison between what you spend and the financial impact you get in return. It goes without saying that businesses are always looking for a positive ROI, or for investments to end up generating more in financial terms than what they cost.

That’s the profit imperative, after all. But there’s a little bit more to ROI than selling something with a suitable mark up on what you paid for it.

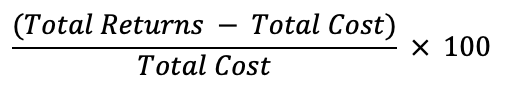

The ROI calculation

In terms of the math, ROI is pretty straightforward. The standard ROI calculation looks something like this:

This gives you the net return as a percentage of your outlay. So say you spend $10,000 on a new POS system but calculate returns at $13,000 over a fixed period of time. Your ROI would be 30%.

Sounds simple, doesn’t it? The challenge comes from working out what your costs and returns actually are.

For example, when you are working out what a POS system costs, you obviously have the upfront expenditure, which includes the purchase price of all the hardware, software licenses, installation fees, and also training costs if you need to get your people up to speed with a new system.

But then there are also the ongoing costs of running the system which should be taken into account. Factoring in things like maintenance and support, cybersecurity and WiFi subscriptions, payment processing fees etc. will give you the total cost of ownership (TCO) of running your POS, which is a more realistic and complete measure.

Calculating returns can be even trickier. The first thing you look at is sales figures. If volumes and overall revenue go up after a new POS installation, it’s tempting to put this down to increased efficiency and throughput unlocked by the new system. But things are often not so simple.

As anyone in business knows, clear linear trends are hard to pick out, especially over shorter timeframes. Sales, revenue and business performance often exhibit peaks and troughs. What’s down to the new POS you’ve just invested in, and what’s caused by other factors?

Quantifying the benefits gained from a POS system in a robust way requires you to take a holistic view. If you see an uptick in overall revenue, can you find enough evidence to attribute that to your POS investment? You might, for example, look for evidence of increased throughput in transaction suggesting better efficiency and therefore more sales. Systems that make better use of customer data through personalization, or have integrated loyalty schemes, might show benefits in increased average order value.

There are cost savings to factor in, too. Again, there are various ways a new improved POS can save your business money, from reduced maintenance costs to providing a better customer experience that helps to reduce customer churn (therefore lowering customer acquisition costs).

So on the surface, working out ROI for a new POS investment seems straightforward. But if you take too simplistic a view of comparing upfront costs to revenue data, you’re potentially missing out on a lot. It’s easy to either miss the benefits and undersell the impact your POS actually has, pushing you towards making another change before it’s necessary, or overstate the returns and stick with a system that’s causing an unseen financial drag on your business.

Ultimately, getting to grips with ROI helps you make better decisions about the POS technology you choose, and when you choose it.

Latest News

KEEP IN TOUCH

NEWSLETTER SIGN UP

| Products | Customer Portal | Contact | About Us |

1859 Bowles Ave, Suite 107

Fenton, MO 63026